A recent PwC survey states that 42% of CFOs are worried about the financial impacts of COVID-19. More financial leaders are now maintaining a positive outlook on their finance operations, as we are slowly emerging from a global pandemic. The fight is not over yet, as 59% of CFOs are concerned about a new wave of the coronavirus, which is already claiming victims in many countries.

Yet, a business must go on; and many financial heads are now taking on the long-due process of optimizing their finance operations.

Some organizations are ahead of others in the race, but everyone can catch up by being proactive. Here are a few tips to optimize and prepare your finance operations for growth in the coming months.

Burn Down The Silos

The restrictive barriers of silos haunt traditional finance operations. Your data is not free-flowing, and developing full visibility into your operations is a pain. According to Accenture, breaking the silos is a major challenge for CFOs around the world, especially after COVID.

However, every business needs to remove the restriction of silos and make way for a cross-functional finance operation. Only then can you make your finance go global and get real-time insights into where your money is going.

Adopting digital transformation can hasten the process of seamless collaboration. Accenture suggests adopting the “anytime, anywhere” model to establish a standard and drive actionable insights.

The mere adopting of financial technologies can make it easier for all departments to collaborate with finance. You don’t need to wait for a month to get a report of the marketing department’s expenses. Or, your employees don’t have to lose productivity as their SaaS payment requests take a month to approve.

All data reaches your finance command center instantly, in real-time, for complete visibility and transparency.

Take Advantage Of Automation

Your finance operations will involve a range of repetitive and laborious tasks you can’t avoid. However, focusing on these tasks is not advisable, as they are mere back-office requirements. Yet, these manual and repetitive processes increase your cost and keep your staff tied down.

Automation can be a great way to reduce the burden of manual tasks for your team. Financial technologies have advanced so far that you don’t need a human to collect or record data. Everything can be done by a digital solution, eliminating the need for manual interventions.

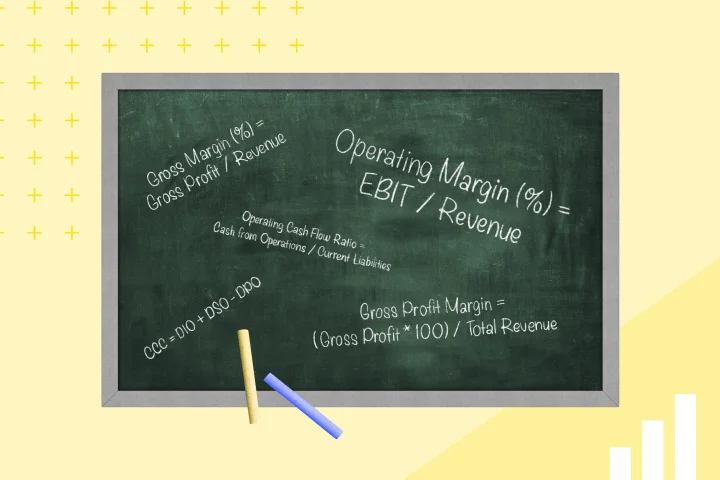

Automation brings in other benefits for the finance department, like a drastic reduction in cost. According to KPMG, automation can help you bring down your general accounting costs by as much as 45%.

Moreover, you can experience a 15% boost in your working capital and a 50% cut in manual reconciliations.

Automating your back-office finance duties lets you unlock productivity and value. You can focus on growing your business instead of busying yourself with counting your dimes. Additionally, you can unleash efficiency and even improve the accuracy of your data. Machines don’t make mistakes like humans, nor are they likely to suffer from tiredness or bias.

Best of all, freeing your resources lets you build more resilience, says KPMG. You can lay a sturdy foundation to improve every aspect of your business and not just finance operations.

As a result, you will be prepared to scale and grow when the demand surges.

Simplify Financial Decisions

The finance department is not the only one to make financial decisions, even if it approves them. Employees from various departments will ask for approvals for expenses or purchases, along with applicable reimbursements.

Evaluating every request is necessary to keep your costs within the budget. However, dealing with so many requests or reimbursements can eat up precious work hours and delay productivity. Yet, you cannot give a free hand to your employees to spend money as you can easily overshoot your budget.

The key is to bring standardization to your financial decision-making. You can go for a spend management system to issue pre-approvals for payments with a single click. The digital solution can also help your employees stay updated on your policies and access them in real-time.

Additionally, you can set up chatbots to guide employees in getting approvals and reimbursements. They don’t need to remember every word of your policy just to subscribe to a service or tool.

The process will help your employees make financial decisions independently. They can also see how much they spent and on what with the click of a button. As a result, you will also be able to establish accountability and know where your budget is going.

Conduct An Audit

Lastly, take a good look at your finance operations to weed out unnecessary expenses. Your departments may still be paying for resources they don’t use or fully utilize. Additionally, many technologies you are investing in might be outdated and replaced with cheaper and better options.

Apart from your records, you might need to seek the feedback of your departments. Ask them to go over their expenses to zero in on any unnecessary ones.

Using spend management software gives you real-time information about your expenses. You can see how much and what each of your departments or employees is paying for. Plus, you can create customized reports on the fly and get a complete picture of your operations.

Optimize your spending based on the findings of your audit.

Prepare Your Finance Teams For Scaling

Strive to convert your money matters into an intelligent finance operation model. Break the silos to enable seamless flow of data for facilitating quick decision making. Shift to financial technologies and adopt digital transformation to become proactive. Automation will also help you to focus on value-added activities and cut costs to a significant extent.

Simplifying your approvals and establishing accountability is also necessary to turn strategic from a merely transactional approach. Additionally, you will be able to remove uncertainties and get much better at predicting the future.

Keep a strong hold on your finance operations to sail the troubled waters post-COVID.

-

Get the latest blogs from Mesh by subscribing to our newsletter