Accounting automation can give your business a big boost when used right. In fact, 83% of accountants believe that technology can make businesses gain a competitive edge, according to Finance Online.

There’s no doubt that a digital solution for automating repetitive tasks can boost productivity and save time. It allows your team to stop worrying about recording everything manually and move to a hands-free approach. Plus, you can help your accountants get back time and energy to do what they are best at — generating insights and guiding strategic decisions.

So, let’s explore how adopting accounting automation will help grow your business.

What is an Accounting Automation?

Simply put, accounting automation is software that gives you the ability to record and keep track of the various finances your company uses to operate in a digital environment. Accounting automation reduces several risk factors commonly experienced by businesses today, from security and fraud to budgeting and over-spending.

Accounting automation can cover everything from corporate spending to payroll to miscellaneous expenses. These systems take care of several time-consuming manual jobs that can free up your employees’ bandwidth for doing more dynamic tasks for your business. So whether it’s producing profit and loss statements, reconciling month-end expenses, or generating important account reports, automation is instantaneous and non-labor intensive.

Challenges of Manual Accounting

Manual accounting presents a number of challenges to accuracy, productivity, and efficiency.

For starters, manual accounting opens the door to human error. When it comes to numbers, a simple data entry typo can throw all the books off. Even wasting valuable time checking and rechecking all entries doesn’t guarantee that a mistake won’t be made.

And that time spent checking the accuracy of manually input data is another drawback to this method of accounting. It takes time and effort on your accounting team’s part, without being able to assure the correct outcome.

Rather than using skilled accountants to perform data entry tasks that could be easily automated, use them for more productive tasks like strategic planning and forecasting.

Plus, automation eliminates the need for storing endless boxes of paper files — a security risk in itself — and allows for financial data to be safely encrypted and stored digitally. It also makes for much easier searching and retrieval of data.

How to Get Started With Accounting Automation

A few simple switches to automated processes can make a huge difference for your business. Here are a few ideas of where you can start.

Expenses

Automating expense reports and reimbursements will save everyone at your organization a lot of time and headaches. Employees can upload receipts digitally, software can automatically scan and retrieve information from the receipt, and approval can be given or declined with automatic notifications to the right people.

Reconciliation

Monthly close is stressful enough without having to manually reconcile every single transaction made for a particular time period. Automation can match your company’s banking transactions to accounting records and highlight any discrepancies that need to be addressed.

Payroll

Payroll is one of the most repetitive and time-consuming tasks to perform manually. Select a software that can automate parts of the process like time reporting, overtime tracking, and tax calculations. Many of these even integrate with your existing ERP or accounting software, eliminating even more manual work.

What to Look for in an Accounting Software

Contrary to what some people believe, accounting software doesn’t exist to replace employees, but rather to help make accounting employees’’ lives easier. As such, some of the features and capabilities you might want to consider when selecting accounting software include:

- Automation

- Availability on the cloud

- Integrations with ERP and other software

- Insights and reporting

- Security

- Customization

Determine what is most important and most helpful for your business, and talk to as many vendors as possible to ensure that you are finding the right fit for your business.

Manage Your Payments With Full Control & Visibility

Benefits of Accounting Automation

Saves Time

Accounting software can help you eliminate the need for manual data entry. You will no longer need to maintain lengthy ledgers with endless rows and columns. Instead, your software can fill in all the entries automatically every time a transaction is made.

For instance, you can set up your accounting system to fetch data from your spend management tool. Your books will be populated with all necessary information at the click of a button. As a result, you can say goodbye to making manual entries in your accounts and ledgers. The time saved is noticed by both the management and the employees. According to Small Business Trends, 44% of employees found automation saves time. Additionally, 43% of professionals feel automation enables them to close tasks quicker.

Saves Money

Automation is vital to reduce your costs and improve profitability. 30% of employees agree that automation helped their organizations save money, as per Small Business Trends. Look below to see how:

- No more need to pay for manual data entry

- E-receipts and invoices save paper and storage costs

- Automated reports save hours worked and labor costs

- Remain compliant and avoid hefty fines

Boosts Productivity

91% of accountants credit accounting technology for improving their productivity, according to Small Business Trends. An automated solution for your bookkeeping can definitely boost productivity and achieve great returns. By streamlining your accounting processes, you’ll have more time and resources to devote to other crucial tasks, like growing your revenue.

In fact, as per Finances Online, businesses that rely on cloud accounting solutions record a 15% year-over-year increase in revenue. Additionally, organizations that use cloud accounting also have five times more customers than businesses that don’t.

So, automation is an essential tool to help your business grow.

Gives You Complete Financial Visibility

Automating your books can help you gain full visibility into your company’s financial situation. Accounting software can update your books in real time and ensure you don’t miss any transactions. For example, your software can instantly capture every expense from a virtual corporate card and populate your accounts.

As a result, you don’t have to wait till the end of the month or year to know where you stand financially. Plus, you have access to real-time information to make decisions on the spot. No wonder, according to Finances Online, 78% of enterprises depend on cloud accounting to run their operations!

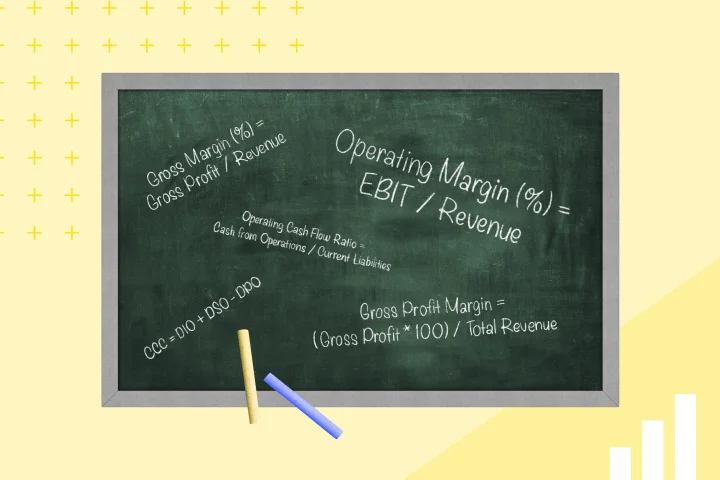

Helps Drive Better Decisions

Having full visibility into your accounting processes creates transparency. Businesses can — and should — remove the guesswork and rely on exact figures to make better decisions. Automation also allows you to trust your data, as it eliminates human errors and improves accuracy.

Your accounting software also lets you create reports with just a few clicks. Businesses can generate custom reports on a range of data to glean insights — presenting a clear picture of the business to the finance team and driving meaningful strategy. For example, you can quickly generate a table, fix the appropriate parameters to include only the relevant data for your query, then the reports are generated automatically.

According to Finances Online, 90% of accountants believe that automating business processes will help companies differentiate themselves from the competition in the coming years.

Provides Foolproof Security

Paper files are the least secure format when it comes to bookkeeping. As a result, traditional accounting practices demand safe storage and constant supervision to protect sensitive data.

Accounting technology is equipped with advanced security protocols to eliminate the security concerns of traditional bookkeeping. You can store your files safely on the cloud, while limiting any unauthorized access.

For added safety, you can even encrypt your data to ward off additional security threats like data breaches and cyberattacks.

Accounting Automation & Spending Management Software

Automating your accounting processes is not the only way you can keep your business in good financial standing. Smart spending software can help your team stay on budget, categorize expenses on-the-go, and reduce fraudulent spending.

A solution like Mesh offers unlimited virtual cards with customizable approval flows, allowing the finance team to control spending according to amount or vendor. This cuts down on any unauthorized purchases that might set the company off-track on its budget. It also easily integrates with many of the top ERP and accounting software on the market.

Accounting Automation Software Systems

As you would expect, there are plenty of accounting automation systems on the market. Each one offers slightly different benefits, so you’ll need to weigh the pros and cons, compare the available plans, and prioritize the features that will be the best fit for your company. These are just a few of the most popular automated accounting software options out there:

Intuit QuickBooks

Intuit QuickBooks offers products for small and medium sized businesses to help them track, organize, and manage their finances. Available features include accounting, payroll, and time-tracking services. Quickbooks receives especially high ratings for its ease of use and ease of set-up.

Capterra rating: 4.3 stars

G2 rating: 4.5 stars

FreshBooks

Freshbooks is an online accounting and invoicing solution, designed to automate recordkeeping for service-based companies. It strikes a balance between making things fast and easy, while still providing thorough information for your finance team.

Capterra rating: 4.5 stars

G2 rating: 4.5 stars

Oracle NetSuite

Oracle NetSuite is a leading enterprise resource planning (ERP) solution, targeted towards enterprise and high-growth companies. In addition to accounting capabilities, it offers solutions for customer relationship management, HR administration, supply chain management, and more.

Much more comprehensive than solutions geared towards small businesses, ERP solutions like Oracle NetSuite will be more expensive and take more time to set up and train staff on use.

Capterra rating: 4.1 stars

G2 rating: 4 stars

Zoho Books

Zoho Books is cloud-based accounting software for small and medium sized businesses, as well as freelancers. It helps companies and contractors manage their finances, automate workflows, and facilitate inter-department collaboration.

Capterra rating: 4.4 stars

G2 rating: 4.5 stars

Xero

Xero provides accounting services for small businesses. They offer a robust platform for accountants, as well an interface that other parties are able to access and use with ease. The finance team doesn’t have to recreate reports and records to pass on to the rest of the business; clients can simply log in to access the information they need.

Capterra rating: 4.4 stars

G2 rating: 4.3 stars

ZarMoney

ZarMoney is cloud-based accounting software that provides invoicing, billing, expense tracking, reporting, and inventory management features. It is primarily used by entrepreneurs, startups and other growing businesses.

Capterra rating: 4.7 stars

G2 rating: 4.8 stars

Sage Business Cloud Accounting

Sage Business Cloud Accounting (formerly Sage One) is cloud-based accounting software for small businesses. Features allow users to manage cashflow forecasting, invoicing, and payroll from the cloud or the mobile app.

Capterra rating: 4.1 stars

G2 rating: 4.2 stars

Melio

Melio is free software that allows users to automate accounts payable tasks. It aims to minimize manual tasks and maximize cashflow for small businesses across all industries. The software automates vendor payments, and even mails checks on behalf of your business.

Capterra rating: 4.2 stars

G2 rating: 4.6 stars

Wave

Wave provides free, cloud-based double-entry accounting for small businesses. It allows all members of an organization to access financial reporting and data from anywhere. The software also integrates with other software to provide invoicing, receipt scanning, payment processing, and payroll features.

Capterra rating: 4.4 stars

G2 rating: 4.4 stars

Kashoo

Kashoo offers cloud-based accounting software for small and medium sized businesses. It facilitates invoicing and payments, and provides financial data tracking. Kashoo is much simpler and streamlined than legacy ERP options.

Capterra rating: 4.5 stars

G2 rating: 4.6 stars

Do your research, make comparisons, and select the automated accounting software that delivers the most benefit for your budget.

Final Thoughts

Accounting automation is a necessary step to making your bookkeeping efficient and accurate, while increasing your team’s productivity. You can save precious time and effort, and reduce costs by adopting accounting technology. The switch will streamline your corporate bookkeeping processes and hopefully generate impressive ROI.

Of course, automated accounting software is only one aspect of getting your business accounts in order. Corporate payment management, payroll tools, and tax prep software are also essential if you want to keep your business finances running smoothly, avoid inconvenient and costly vendor payment failures, and minimize unnecessary spending. With the right tools in place, your business can save, allocate, and thrive.

FAQs

Accounting automation uses technology to perform repetitive tasks, such as data entry and reconciliation, reducing manual effort and improving efficiency.

Accounting automation reduces human errors, ensures consistent data entry, and saves time by automating tasks that would otherwise be done manually.

Accounting automation software uses algorithms and AI to capture and categorize data, match transactions for reconciliation, and generate real-time reports.

Yes, accounting automation minimizes human involvement, which reduces the chances of errors and can help detect unusual patterns that may indicate fraud.

Consider factors like the software’s functionality, ease of integration with existing systems, data security measures, scalability, vendor reputation, and customer support.

-

Get the latest blogs from Mesh by subscribing to our newsletter