Providing quality benefits can improve employee satisfaction and increase productivity. But how do you know if you’re getting a return on your investment? You’ll need to know how much you’re spending on benefits.

Calculating employee benefits might seem complex and difficult to address directly. The costs of different benefits can vary, and it’s difficult to know which employees will opt in for each type of benefit. There are also other variables to consider, like levels of enrollment or utilization. But calculating these costs doesn’t have to be complicated. The first step is to figure out exactly which kinds of benefits you’re offering or plan to offer.

Different Kinds of Employee Benefits

Employee benefits come in all shapes and sizes, and can vary from one company to another. Most companies offer some of the same basic benefits, like health insurance and retirement, while others also offer things like tuition assistance, employee discounts, gym memberships, or retirement planning services. Let’s take a look at the three main types of employee benefits, and how they can affect your business expenses.

Mandatory Benefits

Some benefits are required to be provided to your employees by law. These federally mandated benefits include Social Security and Medicare, unemployment insurance, workers’ compensation insurance, and Family and Medical Leave Act (FMLA) protections. It’s important to note that while employees have Social Security and Medicare taxes withheld, the employer portion is considered a mandatory benefit.

Social Security (6.2%), Medicare (1.45%), federal unemployment insurance (6%), and state UI (0-10%) are calculated as a percentage of the employee’s salary, up to the taxable wage base. These benefits are relatively easy to calculate; just multiply the benefit percentage by each employee’s wages up to the wage base.

For workers’ compensation insurance, your industry, total payroll, and history of losses determine your premiums. Rates are expressed as a dollar amount per $100 of payroll, ranging from $0.50 to $2.00. To calculate the cost of workers’ comp, you’ll need to know your classification code and rate. All you have to do is divide your total payroll by $100, and multiply the result by the workers’ comp rate.

Although FMLA benefits don’t involve a per-paycheck or per-month fee, they do result in lost productivity and temporary replacement costs. You’ll need to estimate how much FMLA time will be used by employees in order to calculate the overall cost.

Company (Fringe) Benefits

Fringe benefits are offered to employees to supplement their salaries or wages, and might include health insurance, vacation or sick time, retirement plans, gym memberships, company-provided cars and phones, or employee stock options. Some fringe benefits, like health insurance and retirement, often require a contribution from the employee. The type and cost of these benefits can vary widely.

The relative cost of fringe benefits depends on what type your company is offering. For example, group health insurance premiums are based on things like the location of your business, total enrollment, the ages of enrollees, and whether or not they use tobacco. You can lower health insurance costs by passing along part of the expense to your employees. Most employees cover at least 50% of the premium, but the insurance provider might require more.

Retirement benefits costs also depend on the type of plan you offer: either a defined benefit plan or a defined contribution plan. Defined benefit plans provide a specified benefit to your employee when they retire, and an actuary determines your annual cost. Defined contribution plans guarantee that you’ll contribute a certain amount in the current period, and costs are determined by your company matching policy. For example, you might match 100% of each employee’s contribution up to 5% of wages.

No-Cost Benefits

Aside from mandatory and fringe benefits, many companies also offer no-cost benefits: additional perks that are provided to employees at no cost to them or the company. No-cost benefits might include options for flexible hours or working from home, bring-your-dog-to-work days, a casual dress code, or flexible spending accounts.

While flexible spending accounts do involve monthly or annual costs, there’s an overall net gain for you as the employer. These accounts allow employees to set aside part of their pre-tax wages for qualified expenses. Since the amounts contributed are pre-tax dollars, your payroll tax expense is reduced. In most cases, the plan administration cost is less than the tax expense reduction, resulting in a net gain for you.

How to Calculate Employee Benefits

Once you’ve determined which benefits you’ll offer and their related costs, the final step is to calculate the total cost. You’ll need to add up the costs of your mandatory benefits and your chosen fringe benefits, and consider any no-cost benefits that provide savings. You may also want to include administration costs in your calculation. These are the expenses associated with providing employee benefits, such as software costs, labor for your staff, or fees to outsource tasks.

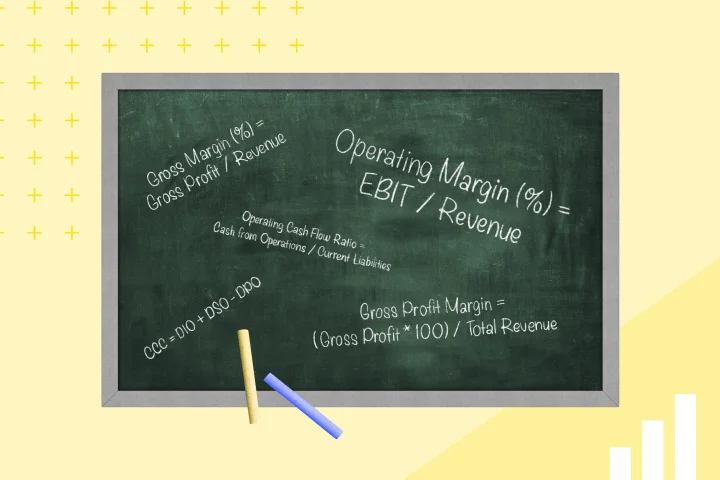

Use this simple formula:

Total employee benefits costs = mandatory benefits costs + fringe benefits costs +/- no-cost benefits + administration costs

In order to accurately calculate your employee benefits costs, there has to be effective collaboration between the HR, Payroll, and Accounting departments. You can use expense management software to facilitate this cross-functional collaboration and data collection, saving your team considerable time and effort.

Why Does the Cost of Employee Benefits Matter?

Calculating the cost of employee benefits can offer significant value for your company. This metric can help to inform decisions about hiring additional employees, improving or removing the benefits offered to current employees, and preparing budgets and cash flow forecasts. By including this data in automated expense management, you can gain valuable insights to help maximize your company’s cost efficiency and success.

FAQs

The three main types of employee benefits are mandatory benefits, company benefits, and no-cost benefits.

Examples of mandatory benefits include Social Security, Medicare, unemployment insurance, workers’ compensation insurance, and Family and Medical Leave Act (FMLA) protections.

Social Security tax is 6.2% of an employee’s salary up to the taxable wage base, while Medicare tax is 1.45% with no wage base limit.

Fringe benefits supplement salaries and can include health insurance, vacation time, retirement plans, gym memberships, company-provided cars and phones, and employee stock options.

Group health insurance premiums depend on factors like location, total enrollment, ages of enrollees, and tobacco use. Employers often share part of the expense with employees.

Examples of no-cost benefits include flexible hours, work-from-home options, bring-your-dog-to-work days, a casual dress code, and flexible spending accounts.

FSAs allow employees to use pre-tax wages for qualified expenses, reducing employers’ payroll tax expense and providing potential cost savings.

Calculate the total cost by adding up mandatory benefits, chosen fringe benefits, considering savings from no-cost benefits, and factoring in administration costs.

Calculating benefit costs informs hiring decisions, benefit improvements, budgeting, and helps maximize cost efficiency for overall company success.

Cut expenses & continue to operate efficiently

Download the Guide

-

Get the latest blogs from Mesh by subscribing to our newsletter