Financial planning and analysis (FP&A) is key for every company, no matter how big or small they are. But, according to Gartner, only 3% of companies have financial planning procedures that are actually integrated into the business procedure.

So, what does financial planning really mean? How does it help businesses and what is the role of a financial planning team in the functioning of a company? We will answer all these questions and more in this blog post.

What is financial planning and analysis?

The FP&A department helps the senior managers optimize the financial situation of the company by analyzing business performance. They are responsible for planning, forecasting and budgeting to support the overall financial health of the company and guide major business decisions.

What does a financial planning and analysis team do?

Now that we understand the overall objectives of FP&A, what exactly to the team members do? Some of the main tasks performed by FP&A include:

- Analyzing the financial model in place previously and proposing any changes that need to be made within the organization

- Creating and updating budgets for the operation of the company as a whole as well as individual teams

- Predicting the financial performance of the brand in the future and create appropriate forecasts to use

- Helping the executive team manage cash flow based on the data collected and submitted

- Ensuring that the company moves in the right direction to ensure that their financial goals are being met regularly

With all these key responsibilities, it is easy to see why the findings of the team are key to making the right business decisions.

The structure of a financial planning and analysis team

The chief financial officer (CFO) is the primary decision-maker in an organization, and is the person to whom the FP&A team reports. Their decisions are driven by the findings of the team. The advising team of the CFO mainly consists of three broad departments:

Accounting

The accounting team is responsible for creating the financial reports of the organization such as the books and the ledger. The balance sheet, the income statement showing the profit and loss are all key documents that are needed to accurately analyze the financial situation of the company.

Treasury

The treasury is led by the treasurer, who is responsible for managing the cash flow, debt and equity. Their main role is to ensure that the financial investments are profitable and that the company is liquid. This helps the company know how much cash flow they need to have to weather a market shock or unforeseen circumstance. It also tells the company where they can or can’t spend money.

Financial planning and analysis team

Forecasting, budgeting and financial planning are all included in the tasks of a financial planner. In some cases, they may also be asked to determine the pricing of products and evaluate the investments made by the company.

By analyzing the reports made by the other departments, an FP&A team can see and determine which part of the company’s product generated the largest profit. Similarly, they also find out the products with the lowest profit margin.

What’s the difference between accounting and FP&A?

The key difference between the accounting and FP&A teams is that while the accounting team is focused on looking at the financial past of the company, the other is looking towards the future.

Accounting reports on money that has already been spent, while the FP&A team aims to determine how a company can best spend their money going forward.

Primary statements for FP&A teams

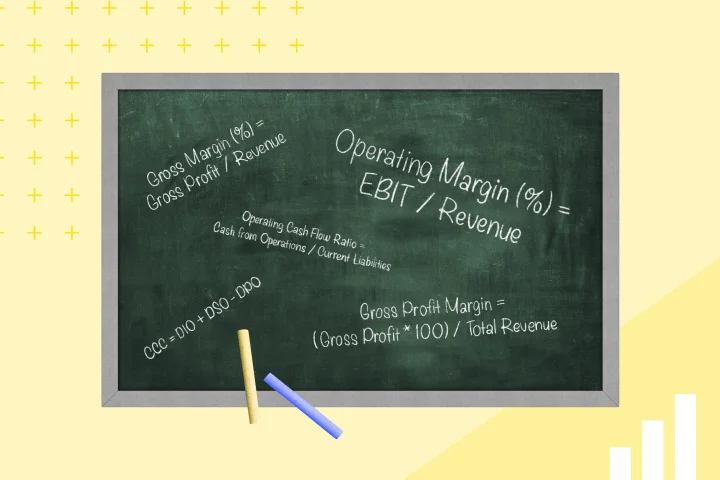

The three types of financial statements that FP&A primarily focus on are:

- P&L statement

- Balance sheet

- Cash flow statement

A profit and loss statement summarizes the revenues, costs and expenses incurred by a company over a period of time. This kind of statement is used to calculate the company’s net income by subtracting the costs from the total revenue.

The balance sheet is another critical statement that determines a company’s value at any given time. It provides a snapshot of what the company owns, as well as what it owes. Balance sheets are comprised of assets, liabilities and shareholders’ equity. Total assets should always equal liabilities and equity combined.

Finally, a cash flow statement provides details of a company’s cash during a specific amount of time. It takes into account the operating activities, investing activities, and financing activities of the business. By combining the earnings or loss of these three categories and adding it to the beginning cash balance, you get the end cash balance.

Benefits of having an FP&A team for your business

Now that we have a clear idea about the work and the responsibilities of financial planning and analysis in a company, let’s take a look at the benefits of having such a team on hand:

Stronger business decisions

Through the analysis provided by the team, officials can make more informed and rational decisions about the investments that need to be made.

Growth optimization

When you have all the necessary details about the areas for growth in the company, you can double down on them and make changes to your business model accordingly.

Increased productivity

Talking about the business as a whole, when you know the areas that need improvement, you can start tweaking the operations to ensure growth in that specific part.

Conclusion

A financial planning and analysis team is crucial for making the right decisions, which ensure the growth of a company. To work at the optimal level, the FP&A team needs the right tools.

If you’re looking to equip your team with the best financial software on the market, Mesh Payments can help.

Our products can provide all the important metrics to your team so that you can make the important decisions. So, take the next big step towards the growth of your brand, starting today.

-

Get the latest blogs from Mesh by subscribing to our newsletter