Now that the pandemic is subsiding and economies are pushing for growth, raising profits is a priority for all businesses. Finance leaders are expected to play a greater role than ever in driving that growth. But they’re also coping with budgets that haven’t yet returned to pre-pandemic levels, rising labor costs, and a growing skills gap. Plus, they’re under pressure to lead initiatives in new areas like digital culture and tech-enabled transformation.

Modern finance teams have to do much more with less. This requires them to reformulate workflows and processes to take advantage of automation and free up time to focus on growth. A study by PWC reported that this year, 80% of CFOs intend to invest in automation to help them cope with increased labor costs and ongoing supply chain problems. This is the essence of scaling: finding ways to get more value out of the same resources.

Here are 10 guiding principles that can help CFOs to scale and automate their organizations’ financial operations.

10 Keys to Automating and Scaling Your Financial Operations

1. Start With a Strong Foundation

Even the most advanced and effective automation technologies won’t deliver the desired results if you introduce them too soon. First you have to build a solid foundation so that new tools and processes can work efficiently.

That means ensuring that there aren’t any silos between departments, and that lines of communication are strong. Finance teams should have real-time access to all the data they need, no matter the source. For example, expense data should reach them automatically and immediately, without anyone having to chase down reports or receipts.

You also need to make sure that everyone is on board. All employees, both in the finance department and across the organization, should understand the benefits of automation and be willing to learn new skills if necessary. Reskilling and upskilling should happen well before any new data management platforms are implemented.

2. Apply Automation to Unlock Operational Efficiencies

To scale finance effectively, start by making small tasks more efficient. Minor activities like validating finance data or processing payments can take up a disproportionate amount of time. When you automate those tasks, you’ll enable operational efficiencies that allow you to pay more attention to the bigger challenges later.

For example, 65% of businesses spend 14 hours a week on payment collection tasks, and 72% reported that this was holding them back from driving growth. If they were to automate these processes, they could spend an extra 14 hours on other responsibilities every week.

Look for ways to help your team deliver more value—not just to cut costs. If you’re not sure where to introduce automation, look for repetitive tasks and identify time-consuming processes. These are often the areas that have the most potential for automation and the biggest impact on scaling.

3. Empower the Rest of the Company to Operate Independently

Finance departments need oversight of spend decisions. But if other departments have to request approval for every purchase, it holds the finance team back from pursuing growth-related activities. The resulting interruptions make it difficult for them to focus on strategic tasks. At the same time, you don’t want to lose visibility into company purchases or risk having shadow IT grow without you noticing.

Automated processes like distributed spend management allow departments to make independent buying decisions without the risk that they’ll overspend or purchase redundant tools. Solutions like chatbots and automated reminders help employees comply with company policies and get pre-approval for transactions without having to consult the finance team.

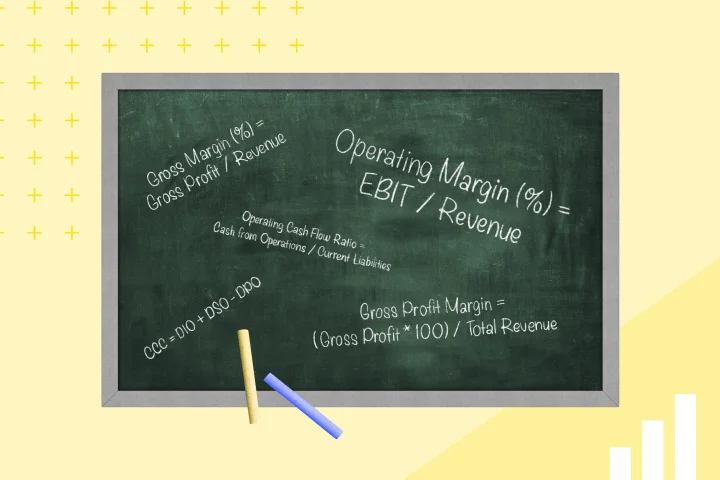

4. Ensure Real-Time Access to KPIs

You can’t scale finance operations without complete access to real-time spend insights. You need a business intelligence dashboard that tracks all your top KPIs and key metrics in real time. This way you can instantly see how the business is performing and track any changes in the organization or markets. If you’re relying on outdated data—even if it’s just a few days old—you’ll be one step behind business trends and blind to current realities.

Whatever tool you choose, make sure it’s user-friendly. It’s not enough to just have real-time KPI reporting; your entire team needs to be able to view it and understand the visualizations independently. If data scientists have to help people interpret the dashboard every time they need information, it’s not going to serve its purpose.

5. Implement Enterprise Resource Planning Systems

Enterprise resource planning (ERP) systems are software solutions that enable businesses to integrate processes across multiple departments. ERPs provide a centralized platform for managing data, automating routine tasks, and optimizing internal processes.

The importance of ERPs for operations lies in their ability to streamline and automate complex business processes, enhance productivity, reduce operational costs, and improve decision-making. ERPs can also improve customer service by providing a comprehensive view of customer interactions and preferences.

Compliance with regulatory requirements is often managed through specific ERP systems as well. This reduces the risk of errors, improves data security, and fosters collaboration and communication between different departments and regulatory agencies.

To build an effective ERP system, each part of the business needs to provide accurate and timely information that translates to reliable KPIs. Having people or machines input key data is essential to build a streamlined and comprehensive system. Without consistent data entry, ERPs become stale and irrelevant.

After implementing ERPs, the next logical step is to establish a reporting structure and consistently measure KPIs. This creates a feedback loop that allows you to fine-tune your operations over time.

6. Leverage Cloud-Based Solutions

Cloud-based ERP solutions, also known as SaaS (software-as-a-service), are software solutions that are hosted on remote servers and accessed via the internet. They offer several advantages over traditional ERPs, such as lower upfront costs, faster deployment, automatic software updates, flexibility, and scalability.

Cloud-based solutions can be accessed from anywhere with an internet connection, making it easier for people to work remotely. This enables businesses to offer flexible working arrangements, which can improve job satisfaction among employees and help to attract and retain talent.

Here are some steps to help you choose the right cloud-based solutions for your business:

- Identify business needs. Start by identifying the processes that are critical to your organization and evaluating the features you need. This will help you narrow down your options and focus on the most relevant solutions.

- Consider scalability. Look for a solution that can grow with your business. Consider its ability to handle a growing number of users, transactions, and data volume, and ensure that it can integrate with other applications. This will make it easier to adapt to changing market conditions and customer needs.

- Evaluate security. Make sure that the provider has appropriate security measures in place, such as encryption, firewalls, access controls, and regular security updates. Consider its track record in data protection and privacy.

- Check for customization. Look for a solution that can be customized to meet your unique needs. See if it allows third-party integrations and supports APIs so that you can connect it with other applications.

- Consider usability. The solution should be user-friendly and easy to navigate. Look for features like mobile accessibility, an intuitive user interface, training resources, and customer support.

- Evaluate costs. Consider the total cost of ownership, including the subscription fee, implementation costs, customization, maintenance, and upgrades. Look for a solution with transparent pricing and no hidden costs.

Here are a few examples of common cloud-based accounting solutions:

- QuickBooks Online: This is the most popular cloud-based accounting software, and is widely used by small- and medium-sized businesses. It offers a range of features including invoicing, expense tracking, inventory management, and payroll. QuickBooks also integrates with over 600 third-party apps and offers mobile apps for iOS and Android.

- Xero: This is a leading low-cost software solution that provides businesses with tools for managing their finances, invoicing, expenses, and payroll. Xero also integrates with over 800 third-party apps and offers mobile apps for iOS and Android.

- SAP Business ByDesign: This is a cloud-based ERP solution that helps businesses to manage projects, finances, customer relationships, and the supply chain. Its modular design allows you to select the features you need to scale as your business grows. It also integrates with other SAP solutions and third-party apps, making it a clear choice if you have other ERP systems.

7. Implement Advanced Analytics and AI

Advanced analytics refers to the use of complex data analysis techniques to gain insight into performance and identify trends. It typically involves using statistical and machine learning algorithms to analyze large data sets from various sources and generate actionable insights. Advanced analytics can improve operational efficiency, reduce costs, and improve decision-making.

Artificial intelligence (AI) refers to the ability of machines to perform tasks that typically require some level of human intelligence, such as perception, reasoning, learning, and decision-making. AI is used in ERP systems to automate routine tasks, provide intelligent insights, and enable predictive capabilities. AI-powered ERPs can help businesses to reduce errors, improve productivity, enhance the customer experience, and drive innovation.

In many ERP systems, advanced analytics and AI are becoming increasingly important. By integrating these newer technologies, businesses can gain deeper insights into their own operations, identify systemic patterns, and predict future outcomes. This can lead to better decisions, optimized processes, and improved bottom lines.

Here are some examples of how advanced analytics and AI can be used:

- Predictive maintenance: Using AI to analyze machine data and predict when maintenance is required, helping to reduce downtime and associated costs.

- Demand forecasting: Using advanced analytics to analyze sales data and predict future demand, enabling businesses to optimize inventory levels and reduce waste.

- Fraud detection: Using AI to identify potential fraud in financial transactions, helping to reduce losses and improve compliance.

- Intelligent automation: Using AI to automate routine tasks, such as data entry and invoice processing, helping to improve efficiency and prevent errors.

Implementing advanced analytics and AI requires intensive planning and thorough execution. Here are some steps that can help you achieve this:

- Define organizational objectives: Start by setting goals and identifying the areas where you want to use these tools. Objectives could include improving forecasting accuracy, reducing costs, or enhancing the customer experience. This helps to create a clear roadmap for implementation and measure future success.

- Assess your data: Analyze your data sources to determine what data is available, as well as its quality and relevance. See if it’s clean and complete, and if not, make a plan to scrub it. Ensure that you have the necessary infrastructure in place to store, manage, and back up your data.

- Choose the right tools: Evaluate all the available options and decide which ones fit your needs. Consider factors like ease of use, scalability, compatibility, and cost.

- Define your models: For example, you might use regression analysis to predict future sales, or a machine learning algorithm to identify patterns in customer behavior. Ensure that your models are accurate, reliable, and aligned with your goals.

- Implement your models: This could involve working with the vendor to configure your system or building custom integrations. Ensure that the models are well configured and that data is flowing correctly. Connect as many API points as possible, and test connections for data integrity.

- Train your team: Make sure everyone knows how to use the new system. This could include training on how to use the advanced analytics and AI tools, or guidance on how to interpret insights.

- Monitor and improve: Monitor your system to ensure that it’s generating the insights you need, and make improvements if necessary. Continuously evaluate the performance of your models and adjust them to improve accuracy and relevance.

8. Enable Data-Driven Decision-Making

Data-driven decision making (DDDM) is the process of making business decisions based on data analysis and interpretation, rather than intuition or personal experience. DDDM involves collecting and analyzing data from various sources to gain insights into business operations and identify opportunities for improvement.

Data-driven decision-making is becoming increasingly important for business operations due to the sheer volume of data that’s now available. By leveraging it, businesses can gain valuable insights into customer behavior, market trends, and operational efficiency—and then make strategic decisions accordingly.

Some of the key benefits of data-driven decision-making include:

- Improved accuracy: DDDM is based on factual data, which reduces the risk of errors and biases that may arise from intuition or personal experience.

- Increased efficiency: By analyzing data, you can identify opportunities to optimize processes, reduce waste, and raise productivity.

- Better-informed decisions: DDDM gives businesses a deeper understanding of their operations and the market, allowing them to make smarter decisions.

- Competitive advantage: Businesses that use DDDM can gain an edge over competitors by identifying new opportunities, optimizing operations, and improving customer satisfaction.

An ERP system can enable DDDM by providing a centralized platform to collect, store, and analyze data from various departments and processes. Here’s how it can help:

- Data centralization: An ERP can collect data from various departments and store it in a centralized database. This allows decision-makers to access and analyze data from different sources.

- Real-time data: ERPs allow decision-makers to analyze up-to-date data and make timely decisions based on current market trends and customer behavior.

- Data analysis: ERPs often come with built-in analytics tools such as dashboards, reports, and data visualization. These tools can help users analyze trends, identify outliers, and gain insight into operations.

- Predictive analytics: Some ERPs include predictive analytics capabilities to forecast future business outcomes. This can include predicting future sales, inventory needs, or potential production issues.

- Improved collaboration: ERPs allow decision-makers from different departments to share information and insights on a centralized platform. This can help break down silos and foster cross-functional collaboration.

If you want to enable DDDM in your ERP system, the first step is to define what data is required for decision-making, where it will come from, and how it will be collected. The ERP should be configured to collect and store data from various sources, such as sales, finance, inventory, production, and customers.

Once the data is collected, it needs to be reviewed, cleaned, organized, and standardized to ensure accuracy and consistency. This includes correcting errors, removing duplicate records, and standardizing formats.

The next step is to analyze the data and use it to inform decisions. By making DDDM a priority, you can encourage a data-driven culture within your organization. Train employees in how to use the ERP system for data analysis, and continually refine your data-gathering and decision-making processes.

9. Build a Strong Finance Team

A strong finance team is crucial for the success and stability of any organization. Not only are they responsible for managing financial resources and ensuring compliance, but they also provide crucial analysis and insights to management. This enables more informed decisions about resource allocation, investments, and business strategy.

The finance team also plays a vital role in risk management and financial reporting. They develop strategies to minimize losses, keep investors happy, and ensure the long-term financial sustainability of the organization.

Here are some basic steps to help you build an effective finance team:

- Define clear roles and responsibilities. This should be done for all positions, from the CFO to financial analysts and accountants. Hire individuals who have the right education, experience, and skills for each role.

- Create a positive work environment. Encourage open communication, collaboration, teamwork, creativity, and innovation. Make sure to recognize and reward achievements and provide positive feedback.

- Set clear goals for each team member. These should include measurable KPIs and performance targets. Make sure to document progress, communicate feedback, and schedule regular performance reviews.

- Invest in training and development. Helping team members acquire new skills and knowledge is key to growing the capabilities of your company. This could include training on new financial software, accounting standards, and regulatory requirements.

- Promote collaboration between departments. This helps to increase efficiency and gives the finance team access to all the data they need to ensure accuracy.

10. Continuously Monitor and Improve

It’s absolutely essential to monitor your financial operations over time and continue to look for ways to improve them. This will allow you to identify inefficiencies, reduce costs, correct errors, improve accuracy, and keep everything functioning properly. Business needs are constantly evolving, and you have to be flexible enough to adapt.

Your ERP system should also be monitored and updated as needed. This will help to ensure that all data is comprehensive, accurate, and up to date. It will also promote compliance with changing regulations, reducing the risk of penalties and legal issues. Look for areas where the system needs to be scaled or upgraded as your business grows.

Here are some strategies for monitoring and improving your ERP system(s):

- Establish KPIs to measure effectiveness. These should be aligned with the goals of the organization and finance team, and may include performance indicators like system uptime, response time, and usage.

- Conduct regular audits. This will help you find opportunities for improvement and identify errors, inefficiencies, and compliance issues that need to be addressed.

- Implement feedback loops. Gathering feedback from users and stakeholders provides valuable information that can be used to improve the system.

- Keep up with technological advancements. Staying up to date with the latest technology will help you understand how new features or functionalities can be used to your advantage.

- Collaborate with other departments. This will help you figure out how the ERP can be integrated with other systems or processes to improve overall performance.

- Continuously test and refine. It’s crucial to identify and address issues as they arise, and the best way to do this is through regular testing.

Growth vs. Scaling

Understanding Business Growth

Let’s start with a simple example. Lisa is a successful graphic designer who earns $100,000 a year designing her client’s websites. She works 30 hours a week and earns about $65 an hour. In order to grow, Lisa has two options – hire an employee so she can increase her company’s revenue or increase her hours, so she is working 40 hours a week. Either way, her business will grow, and, in all likelihood, so will her income.

A small grocery that earns $100 of revenue per square foot can grow by expanding into a larger space; a small business with 15 salespeople promoting its services can grow by building a larger sales team.

In the short term, adding resources typically increases costs until sales catch up. Over the long term, growth will always be somewhat limited by the resources a business is willing to invest.

What Does It Mean to Scale a Business?

Scaling a business takes a different approach to increasing revenue. Rather than continually add more resources, it attempts to increase revenues at a greater pace than costs.

Looking back at our previous examples, one way Lisa could scale is to work the same hours and increase her rates by 25%. The small grocery can work with suppliers to reduce costs, thereby increasing profits, while the small business with the sales team can look for process improvements and automation tools to reduce the sales cycle and increase the number of sales with the same staff.

Technology has improved our ability to scale. A one-to-one phone call is time-consuming and monopolizes the time of a vital resource; sending out an email to 10 people or 1,000 people takes the same amount of time and can drive significant value.

Online businesses typically have the infrastructure to scale. They aren’t limited by the physical dimensions of a store, enabling them to sell more items to a broader audience. Software companies invest a tremendous number of resources in development. Still, their product scales effectively as there aren’t additional costs associated with each unit sold.

How to Scale Your Business

Most businesses prefer scaling to growth because they require less upfront investment. Here are a few tools being deployed by businesses to help scale their business.

Reduce Costs of Products and Services

Evaluate all the costs involved in provisioning a service or manufacturing a product. In addition to reducing your material costs, look for other cost-cutting measures. Look for cheaper labor, negotiate for better shipping rates, and look for ways to reduce office expenses like equipment and rent. Profits will scale upward while maintaining the same level of productivity.

Upgrade Your Products or Services

Another way to increase profits without significant investment is investing in making your offering better. Add new features, upgrade your level of service, and train employees to better handle the needs of your customers. Increasing the quality of the product or experience will allow you to increase prices, helping to scale your business.

Become More Efficient with Technology

In most businesses, there are plenty of opportunities for improvement. Savings in one area of your business, even if it isn’t directly related to sales or the product, has an overall effect on your bottom line.

Look for ways to optimize your spend and find efficiencies in HR. Ensure that your finance team isn’t overstaffed, and take a close look at your marketing ROI.

Invest in Customer Management Tools

Successful businesses don’t just sell to a customer once. They can scale their sales efforts with CRM tools that alert sales and customer success team members that it’s time to reach out to a customer.

Bring on Freelancers as Needed

When you need specialized help, consider onboarding a short-term freelancer who can add to your existing skill set. Rather than investing in an expensive full-time employee, onboarding a freelancer for short periods of time can get you the expertise you need to help scale at a lower cost.

How Successful Businesses Scale

While every business is different, companies that successfully scale follow these steps.

Committed to Growth

It may seem obvious, but a company that is not committed to growth simply won’t scale. For example, a three-person law firm with a paralegal and secretary may be comfortable with their level of income. They lack the motivation to scale their business and, as a result, never will.

For businesses to scale, ownership must be committed to this path of growth.

Leadership Skills

Scaling is a reflection of the company’s owner or CEO. They need to lead by example, demonstrating a drive to find new, better ways to grow their business.

Onboard the Right People

Scaling won’t happen by itself. It takes a team focused on success to pull together and move the company forward. Look for employees that are multi-talented and necessary for your operations. They will ensure that the company stays flexible and can pivot in the face of change. Other tasks can be outsourced as needed.

Focus on Processes and Automation

Automated processes and tasks save time and allow team members to get more done. Review processes throughout the company, looking for ways to make tasks more efficient. This may require some initial IT investment but will pay off down the road when operations are streamlined, and the company is a scalable model.

The Key Differences Between Growth and Scaling

As mentioned earlier, in growth mode, revenue and expenses are tied together, while in a scale model, revenue is exponentially higher than expenses. A growth company may have $15M in revenue with $12M in expenses, leaving it with a $3M gross profit. Contrast that with a scaling company that has $15M in revenue with only $7M in expenses, for an $8m gross profit.

Growth vs. Scaling: Which Is Better?

Scaling a business drives higher profits as it pushes a company to be more efficient. For most businesses, it is a superior model to the traditional “You gotta spend money to make money” approach.

However, implementing a scalable model is not simple. It requires careful planning, executing the right system, care hiring practices, the right partners, and robust technology.

The Bottom Line

Finance teams have a lot to manage, but automating and scaling operations can help you stay on top of it all. From building a strong foundation and establishing KPIs to implementing cloud-based solutions and advanced analytics, there are plenty of moving parts in this process. By following the steps and guidelines above, you’ll be well on your way to optimizing operations and making your finance team as effective as possible.

-

Get the latest blogs from Mesh by subscribing to our newsletter