Managing all the invoices that the accounts payable (AP) department receives each month can be challenging, especially as your business grows. The accounts payable three-way matching process is one of several systems that help to ensure your company pays its bills accurately and on time.

This process enables your AP department to detect different kinds of payment errors, including fraudulent invoices, duplicate invoices, and even minor errors in supplier invoices. Before AP can issue a payment to a supplier, the three-way matching process requires verification of three component documents to check that each contains the same data. This ensures that your company is only paying for items it has actually received.

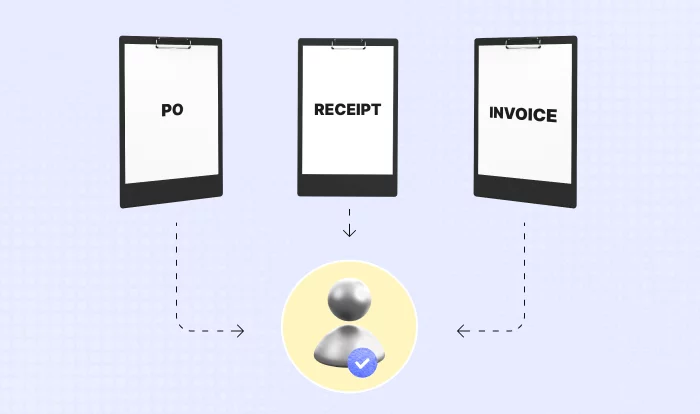

What Is Three-Way Matching in Accounts Payable?

Three-way matching in accounts payable refers to the process of verifying purchase order numbers, supplier details, items, quantities, and order amounts across a supplier’s invoice, purchase order, and delivery receipt. It allows your AP department to identify any inconsistencies that could indicate a supplier error or fraud, and ensures that there are no overpayments.

The Association of Certified Fraud Examiners (ACFE) estimates that companies lose 5% of their revenue every year due to fraud. Implementing a three-way matching process in the accounts payable workflow can save your company significant time and money, eliminate fraud, improve relationships with suppliers, and streamline the auditing process.

How Does Three-Way Matching Work?

The three-way matching process involves three separate components. It requires your AP team to examine three documents related to the purchase, confirming that all the pertinent information is consistent between them before a payment can be issued.

1. Purchase Order

The first step in the procurement process is to submit a purchase order to the supplier. A purchase order should clearly state the supplier, PO number, requested item, desired quantity, and the agreed-upon price. During the three-way matching process, your AP team will verify that the information on the purchase order matches the details of both the invoice and the order receipt.

2. Invoice

The AP department receives an invoice from the supplier once the purchase has been shipped. This invoice is compared to the purchase order and order receipt to confirm that all elements of the documents are the same, including the PO number, the items requested and delivered, the number of items received, and the amount charged per item.

3. Order Receipt

Upon delivery of the purchase, the receiving department completes an order receipt, indicating the items received and the quantity of each. Your AP team will verify the PO number, supplier, items delivered, and quantity received against the purchase order and invoice as part of the three-way matching process.

Once all three documents have been received by your accounts payable department, you’ll need to scrutinize each to verify that all information is correct before payment is issued. If there are any discrepancies in the three components, the AP department may send only a partial payment or temporarily withhold payment. Once the differences are resolved, your AP team can complete the three-way matching process and issue payment.

Benefits of Three-Way Matching in Accounts Payable

Implementing three-way matching in accounts payable offers considerable benefits.

Helps Save Money & Time

Verifying the components of the three-way matching process before paying invoices reduces overpayments for duplicate invoices, items not received, or fraudulent invoices. The process can help the AP department make payments to the supplier more quickly, enabling the company to qualify for early payment discounts.

Eliminates Fraud

Smaller organizations are even more susceptible to invoice scams than larger organizations. The three-way matching process can eliminate the payment of fraudulent invoices. A fraudulent invoice won’t have a corresponding purchase order or order receipt. Because the process requires three documents to be compared before payment can be issued, a fraudulent invoice will be detected immediately.

Streamlines the Auditing Process

Internal and external auditors may examine purchase orders, order receipts, and invoices during an acquisition and payment cycle audit. The auditor needs to follow the purchase process from requisition to payment to verify accuracy, completeness, cut-off, occurrence, and classification. Keeping these documents together will streamline the audit process, saving countless hours for audit personnel.

Strengthens Supplier Relationships

Maintaining accurate documentation and sending prompt payments will improve the relationship between your company and your suppliers, potentially incentivizing better pricing and payment terms. On the other hand, your company may be less inclined to work with vendors who consistently ship inaccurate orders and send erroneous invoices, driving you to pursue relationships with more trustworthy suppliers.

Automating the Three-Way Matching Process

The accounts payable department can automate the three-way matching process with an accounts payable system or perform the process manually. Manual three-way matching is a very time-consuming process and becomes even more strenuous as your company grows. Documents may be incomplete or misplaced, AP clerks might make mistakes when comparing details, and the volume of documentation to sort, verify, and file can be too much for the department to handle.

Fortunately, accounts payable process automation systems can streamline the three-way matching process. These systems can automatically match invoices to purchase orders and order receipts, verifying that the data across each is consistent. When the process is complete, the invoice is submitted for payment. If there are any discrepancies, the documents are flagged for review by the AP department. Automating your three-way matching process is a key element of accounts payable optimization.

-

Get the latest blogs from Mesh by subscribing to our newsletter