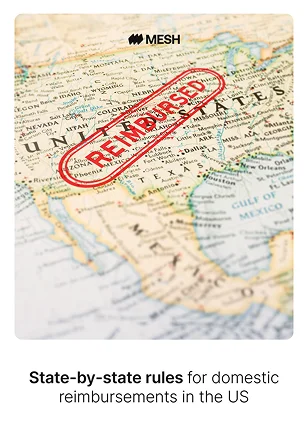

There are no federal rules that require the employer to reimburse specific types of expenses for remote employees. However, according to the Department of Labor and the Fair Labor Standards Act, an employer may not require an employee to pay for work-related expenses if paying those expenses would reduce their earnings below the federal minimum wage.

Beyond that, the federal government has left most decisions up to individual states. Various states have specific statutes regarding employee reimbursement that are important to understand, in order to avoid any legal trouble or other issues. Here are a few of the most relevant examples.

California

Employees who work from home in California are entitled to reimbursement of any necessary expenses or losses directly resulting from the performance of their job duties.

District of Columbia

The District of Columbia requires that employers pay or reimburse employees for the costs of purchasing and maintaining the tools necessary to conduct the employer’s business.

Illinois

Illinois’s Wage Payment and Collection Act states that the employer must reimburse employees for “all necessary expenditures or losses incurred by the employee within the employee’s scope of employment and directly related to services performed.” State law also requires that employees submit documentation to request these reimbursements within 30 days, unless the employer allows additional time according to their written expense reimbursement policy.

Iowa

Employees in Iowa are protected under the Iowa Wage Payment Collection Law. It states that employers shall reimburse employees for expenses authorized by the employer, either before the cost is incurred or within 30 days after the employee submits the request for reimbursement.

Massachusetts

Massachusetts labor laws don’t explicitly establish any rules for expense reimbursement. Employers in the state must abide by federal regulations regarding expense reimbursements; work-related expenses may not reduce the employee’s wages below the national minimum wage.

Minnesota

Chapter 177 of the Minnesota Fair Labor Standards Act prohibits employers from requiring employees to pay for the following expenses, if paying for those expenses would reduce the employee’s wages below the minimum wage: uniforms, tools, or equipment that have no practical use except in their employment; consumable supplies required to perform their job duties; or travel expenses other than those related to transport from the employee’s residence to their place of work.

The statute also allows employers to demand the return of items for which the employer provided reimbursement upon employee termination.

Montana

Employers in Montana must reimburse employees for all necessary expenditures or losses that are a direct result of the employee’s discharge of duties to the employer, according to Title 39 of the Montana Constitution.

New Hampshire

Labor statutes in New Hampshire mandate that employees who incur expenses in the course of their employment that are required by their employer must receive reimbursement for those expenses. The law further states that the employer must provide reimbursement within 30 days of the employee submitting the proof of payment.

New York

New York labor laws do not require employers to reimburse expenses for employees other than those that would reduce wages below the minimum, as per federal law. Reimbursement of expenditures is considered a fringe benefit in the state of New York. However, if an employer has entered an agreement to pay such benefits, they must provide reimbursement within 30 days.

North Dakota

Title 34 of the North Dakota Century Code instructs employers to reimburse employees for all necessary expenses or losses resulting from the employee’s discharge of duties or the directives of their employer. Reimbursement is not required for items the employee uses outside their relationship with the employer.

Pennsylvania

The state of Pennsylvania makes no provisions for expense reimbursement other than those covered by federal law. Expense reimbursements are considered fringe benefits according to the PA Wage Payment and Collection Law. If the employer agrees to provide expense reimbursements, the payment must be made within 60 days of the employee’s valid claim submission.

South Dakota

South Dakota labor laws require employers to reimburse all necessary expenditures or losses incurred by the employee as a result of their performance of duties or directives of the employer.

Reimbursement Exceptions for Your Consideration

It’s important to keep in mind that there may be some exceptions and gray areas when it comes to employee expense reimbursement policy inclusions. For example, in Washington State reimbursements are made at the discretion of the employer. However, there’s an exception for employees working in Seattle, who are entitled to reimbursement of all employer expenses.

It’s essential to be aware of all the nuances of these regulations, and to account for them in your reimbursement policy. Failure to abide by state law could result in damages, penalties, interest, attorney fees, court fees, substantial fines, or even the imprisonment of responsible parties.

To ensure that all remote employees are reimbursed fairly, accurately, and promptly, expense management automation is an invaluable tool. In addition to reducing corporate credit card fraud and overspending, it can increase the efficiency of your finance department.

By using a spend management platform like Mesh and providing your employees with physical and virtual cards, you can eliminate the need for them to fill out expense reports. They’ll be generated automatically instead, greatly reducing the finance team’s workload and helping to keep all your employees—remote or otherwise—happy.

FAQs

No, there are no federal rules mandating specific expense reimbursement for remote employees. However, employers cannot reduce employee earnings below the federal minimum wage by requiring them to pay for work-related expenses.

The federal government leaves most decisions regarding employee reimbursement to individual states. Different states have specific statutes on expense reimbursement.

Yes, there may be exceptions and gray areas in employee expense reimbursement policies. For example, in Washington State, reimbursements are discretionary, but employees working in Seattle are entitled to reimbursement of all employer expenses.

Expense management automation, like using a spend management platform such as Mesh and providing physical and virtual cards to employees, can streamline the reimbursement process. Automation reduces corporate credit card fraud and overspending while increasing the efficiency of the finance department by eliminating the need for manual expense reports.

Download a copy

of these rules to

keep on hand

Download the Guide

-

Get the latest blogs from Mesh by subscribing to our newsletter